Series I savings bonds are paying a high yield—but are they right for you?

Series I bonds (I bonds) are paying 9.62% and are backed by the U.S. government. How is this possible? Well, they are tied to inflation; as inflation increases, the bond yield increases too. If you are wondering if I bonds are right for you, then you are in the right place. This article covers the pros and cons of I bonds to help you decide.

Inflation has skyrocketed from initiatives like stimulus checks, supply chain issues due to Covid-19, and global conflict. In fact, inflation has hit 40-year highs. When the June Consumer Price Index (CPI) data was released, it showed that inflation rose by 9.1% from the previous year.

In a recent article, I explain how to beat inflation if you are looking for other ways to get on top of inflation besides I bonds.

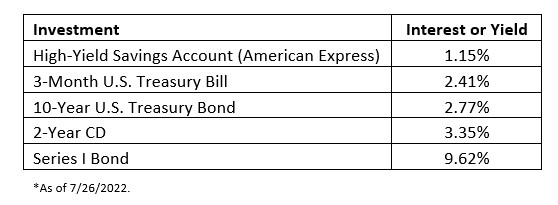

Below is a comparison of safe investments that are backed by U.S. government agencies.

What Is an I Bond?

Series I bonds are issued by the Department of Treasury. They are 30-year bonds but can be cashed in after one year. Below are important details:

- A fixed-income product that pays monthly interest that is added to the principal every six months.

- The interest is composed of two parts:

- A fixed-rate set at purchase.

- An adjusting inflation rate that is set every May and October based on the Consumer Price Index (CPI).

- The maximum purchase per individual is $10,000 per year.

- An additional $5,000 can be purchased if you have a tax refund.

- If you sell your I bond before five years, you will lose the previous three months of interest.

- They are taxable as federal income but are not taxable at the state or local level.

Savings Bond Advantages and Disadvantages

There are advantages and disadvantages to savings bonds.

Pros of Buying I Bonds

What are the benefits of I bonds? I bonds are a great investment for longer-term investors looking for a safe investment. They currently offer a yield of 9.62% vs. the most commonly talked about U.S. Treasury 10-year bond of 2.77% (as of 7/26/2022).

Benefits of I bonds:

- Protect the purchasing power of cash from inflation.

- Are not taxed if used for higher education.

- Buy any amount between $25 and $10,000 per individual.

- Guarantee your principal and interest will not lose money; they don’t have a negative return even in deflationary times.

- Your interest is added to the principal and then compounded.

- They are exempt from state and local taxes.

Cons of Buying I Bonds

I bonds are meant for longer-term investors. If you don’t hold on to your I bond for a full year, you will not receive any interest. You must create an account at TreasuryDirect to buy I bonds; they cannot be purchased through your custodian, online investment account, or local bank.

Potential bonds disadvantages include:

- Maximum investment each year is $10,000.

- Yield is taxed as ordinary income.

- Must open a TreasuryDirect account to buy and sell.

- Interest is added to the principal; you don’t receive income.

- You do not receive statements, so you must log in to TreasuryDirect to view.

How to Buy I Bonds

Here are the instructions to buy I bonds at TreasuryDirect.gov. We have heard the process of setting up an account can be difficult, as the website is dated and not intuitive. To set up an account, you will need to provide the following information:

- Taxpayer ID

- U. S. address

- Checking or savings account

- E-mail address

Once you have set up your account on TreasuryDirect, you can fund your account. Within TreasuryDirect, you can also buy other investments such as Series EE bonds that have historically paid a higher rate but don’t hedge against inflation as well as I bonds.

How to Sell I Bonds and How You’re Taxed

When you decide to sell your I bonds, you must do it through the TreasuryDirect website, and the proceeds will be sent to your checking or savings account of record. Taxes can be paid yearly on the interest earned, but most people defer the interest and pay the taxes when sold or transferred. After you sell your I bonds, you will receive an IRS Form 1099-INT. Remember, if the funds are used for higher education, no taxes are due, and the investment received is interest-free!

Other Considerations

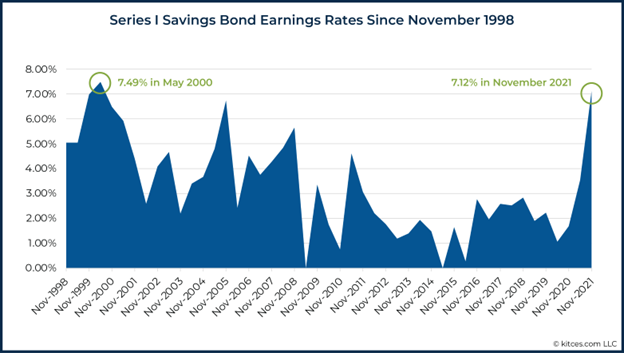

I bonds don’t have negative nominal returns, but historically, they rarely have paid over 4% since 2008. I bonds currently offer a very attractive return, but they shouldn’t be a set-it-and-forget-it investment. If the U.S. moves back to a lower-inflation environment, we would suggest selling your I bonds and reallocating based on your goals.

https://www.kitces.com/blog/federal-series-i-savings-bonds-inflation-712-composite-rate-treasurydirect-compare-fixed-income-investments/

Are I Bonds Right for Me?

I bonds are great if you are looking for an investment that protects you from inflation, is backed by the U.S. government, and currently has a very high interest rate. However, if you have a short-term investment horizon, want to invest over $10,000 per year, or don’t want to open another online investment account, you may want to look at the other choices that I mention in my “how to beat inflation” article.

Remember that I bonds have an extraordinary rate, but if/when inflation subsides, so will the rates that they are paying.

Consider working with a financial advisor who can help you determine the optimal tools and strategies based on your situation. Our Spokane financial planning firm offers a complimentary insight meeting. We invite you to schedule a meeting today.