Editors Note: This post has been updated to reflect recent legislative changes that happened July 1, 2025.

- Washington state doesn’t have an inheritance tax but it does have an estate tax for estates over $3 million.

- Recent updates have raised the top estate tax rate to 35%, which has made proactive planning (like trusts and gifts) more important than ever.

- There are many ways you can reduce future taxes, including giving while you’re still alive, using irrevocable trusts, and working with professionals, such as your financial advisor.

When planning for the transfer of wealth, understanding your state’s tax laws is essential. Many people wonder whether Washington State inheritance tax is due on money they recently inherited from a loved one who passed away.

Others may want to understand how to minimize taxes for their own family after they pass.

Context for Estate and Inheritance Taxes

Estate and Inheritance taxes are significant because they can directly reduce the amount of money passed from one generation to the next. Without proper planning, the resulting tax liability can be high.

Another challenge is that many folks die with valuable illiquid assets, such as a home or personal property, which might need to be sold to cover the estate tax. For families who want to keep these assets for sentimental reasons, planning ahead is essential to avoid a forced sale.

Every state has different rules, but careful planning is especially important if you’re inheriting a Washington State estate or you’re a person residing in Washington and you hope to leave a legacy.

Purpose and Scope of This Guide

This guide breaks down Washington State tax laws and how they affect the process of passing down wealth after someone’s death.

After reading, you will understand the difference between Washington State inheritance tax and estate tax, key tax thresholds and exclusion amounts to be aware of, ways to reduce your tax liability, and answers to common questions about estate planning in Washington State.

Washington State Estate Tax Changes Effective July 2025

Washington has increased its estate tax rates, with the top marginal rate rising from 20% to 35%. At the same time, the estate tax exemption was raised to $3 million, helping shield smaller estates from taxation. For larger estates, however, the new rates could push total taxes (state + federal) to over 70%.

In this guide, we explain what the changes mean for your Washington State estate tax liability, share planning strategies like trusts and gifting, and offer practical tips to help preserve wealth for your heirs. Planning ahead matters now more than ever.

Understanding the Basics: Inheritance Tax vs. Estate Tax

Estate tax and inheritance tax are often confused because both apply after someone’s death, but each is distinct and requires different planning strategies.

Inheritance Tax Overview

An inheritance tax is a tax assessed on the value of property inherited by the heir of a decedent. The tax is paid by the surviving heir after assets are distributed from the decedent’s estate.

Estate Tax Overview

An estate tax, as defined by the IRS, is a tax on your right to transfer property at your death. Unlike an inheritance tax, which is paid by the surviving heirs, an estate tax is assessed on the value of the decedent’s estate before being passed down to heirs.

Why the Distinction Matters

While this differentiation may seem minor, it’s important to clarify. Essentially, the difference comes down to two things: when and on whom the tax is assessed.

Inheritance taxes are rare as there is no federal inheritance tax and only five states impose a state-level inheritance tax as of 2025. There is however a federal estate tax, though it affects only a select number of households due to the high exemption amount. Additionally, 12 states impose a state estate tax.

If you have a taxable estate, understanding which tax applies to your situation can guide you in your estate planning and help you minimize the amount of your money that goes to your state’s department of revenue when you pass.

Does Washington State Have an Inheritance Tax?

Washington’s Stance

Fortunately, there is no Washington State inheritance tax. This means that a person residing in Washington who receives assets from a Washington decedent’s estate will have zero personal tax liability for the assets they’ve received.

Implications of Out-of-State Assets

It is worth noting that, in certain situations, a Washington resident could be subject to inheritance tax assessed by another state.

For example, Kentucky is one of the few states that has a state inheritance tax. Therefore, a Washington resident could be forced to pay taxes to the Kentucky Department of Revenue if they inherit assets from a person residing in or owning property in Kentucky.

There are currently only six states that assess a state inheritance tax:

- Iowa*

- Kentucky

- Maryland

- Nebraska

- New Jersey

- Pennsylvania

*Iowa’s inheritance tax is no longer effective for assets inherited after December 31, 2024 but may still apply for assets inherited in prior years.

When you inherit money or property from a loved one, check the tax laws in the state where they lived to see whether any tax is due.

Potential Confusion Points

It’s understandable why estate tax and inheritance tax are often confused—they both involve taxes being paid from the deceased person’s assets.

Currently, only one state, Maryland, imposes both a state estate tax and an inheritance tax, meaning the same assets can be taxed twice.

We often hear from people who have just inherited money and are worried about how much they need to set aside for taxes. The good news for Washington residents? In most cases, it’s zero!

To get a deep dive into how to handle an inheritance and proactive ways to lower any taxes you may owe, schedule a call with our team.

Washington State Estate Tax: What to Know

While there is not a Washington State inheritance tax, there is a Washington estate tax for residents to be aware of.

State-Specific Threshold

As of July 1st, 2025, Washington’s estate tax exemption threshold is $3,000,000 and is expected to be indexed for inflation annually. This means that if a Washington resident passes away with assets exceeding $3 million, they have a taxable estate and an estate tax return must be filed.

This means that Washington residents with assets below this exemption threshold will not owe estate taxes. Keep in mind though: it’s not based on what you have today but what you have on the day you die.

Although a state-imposed estate tax may not be ideal, Washington’s lack of a state income tax makes it an attractive option for many retirees.

How the Estate Tax is Calculated

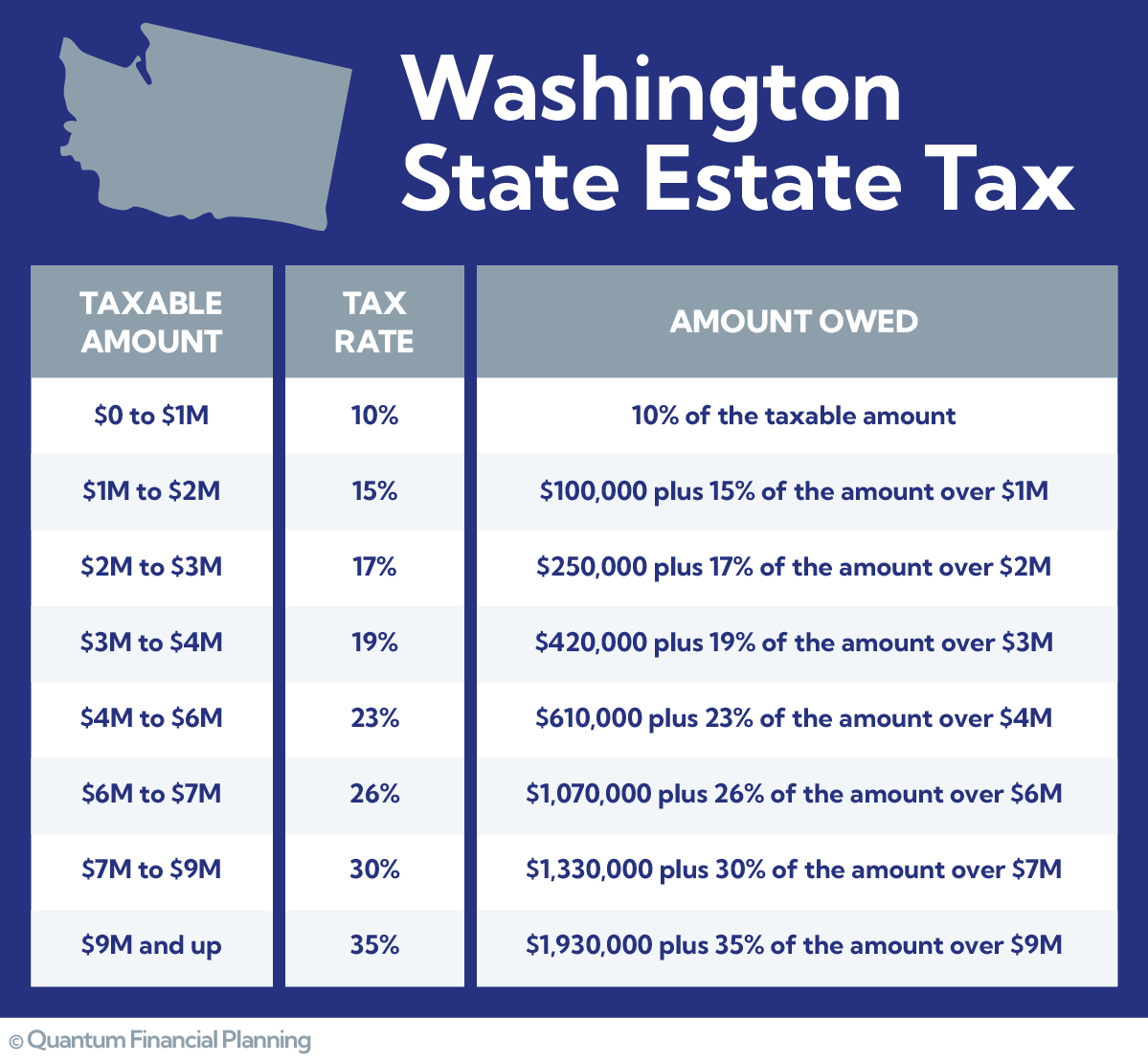

For a Washington estate exceeding the exemption threshold, the tax is progressive, much like federal income tax brackets. The first $3 million is tax-free, and the tax rate on the remaining taxable amount depends on the estate’s size, per the table below:

Be sure to check the Washington Department of Revenue for details on the Washington estate tax, including up-to-date exclusion amount and tax rates.

Federal Estate Tax Context

The Washington State estate tax is independent from the federal estate tax.

The federal estate tax applies to only a small number of ultra-wealth individuals as the exclusion threshold is much higher, ($13.99 million for 2025).

Washington’s lower exemption means more families could face the state estate tax. This makes estate planning essential to minimize taxes and protect your wealth for future generations. However, for Washington residents with a taxable estate over $13.99 million at date of death, both federal and state estate taxes will apply.

Although the federal exemption is much higher than the Washington estate tax exemption, the federal tax rate starts at 18% and climbs quickly to a maximum rate of 40%.

Upcoming or Potential Legal Shifts

Tax laws frequently change, and the federal exemption amount adjusts annually for inflation. As of March 2025, the Tax Cuts and Jobs Act (TCJA) of 2017 is set to expire at the end of the year.

The Trump administration has expressed plans to prevent this sunset, as it would significantly reduce the federal estate tax exemption and subject many more Americans to the tax.

Stay informed by checking the IRS and the Washington State Department of Revenue for the latest tax laws and rates because the limits can change.

Minimizing Estate Tax Liability in Washington

If you’re concerned about being affected by the Washington estate tax, here are some strategies to help minimize the potential tax liability for a taxable estate.

Gifting Strategies

One simple way to reduce your potential estate tax burden is to give money away while you’re alive and maximize the use of your annual gift tax exclusion.

As of 2025, the IRS allows individuals to gift up to $19,000 per recipient each year without triggering any tax consequences or requiring a gift tax return. This annual gift amount is set by the IRS and adjusted each year for inflation.

There’s no limit to the number of gifts you can give, as long as each recipient does not exceed the maximum annual amount. A married couple could each gift up to the threshold, doubling their effective per-recipient maximum.

Parents often choose to start gifting assets to their children later in life. Many already plan to pass these assets down someday, but gifting while alive helps lower the taxable estate and reduces estate taxes.

What happens if you gift more than the annual gift tax exclusion amount ($19K in 2025)? You may be required to file a gift tax return (IRS Form 709) and your lifetime federal estate tax exclusion may be reduced.

Trusts

Per the IRS, a trust is an arrangement formed under state law in which one person holds title to property, subject to an obligation to keep or use the property for the benefit of another.

The term “trust fund” is often used interchangeably with “trust,” but it typically refers to a trust that holds investments or cash for distribution to its beneficiaries.

Trusts can typically be categorized into two types: Revocable Trusts and Irrevocable Trusts:

- Revocable Trust – A revocable trust is an arrangement that can be changed, adjusted or, as its name implies, revoked at any time during the life of the trust’s creator (grantor).

- Irrevocable Trust – An irrevocable trust cannot be altered or revoked by the grantor after it has been established with very few exceptions.

Both types of trusts are common in estate planning, but only an irrevocable trust is considered separate from the estate, making it a useful tool for reducing estate taxes.

An irrevocable trust lets you establish a trust fund for the next generation by transferring appreciating assets like stocks, bonds, and mutual funds. This allows you to gift assets at their current value while excluding their future (and likely higher) value from your estate.

Simply put, this can be a more efficient way to give. For example, if you set up an irrevocable trust fund with $1 million at age 60, and it grows at an average rate of 7.2%, it could grow to over $4 million in 20 years—removing those assets from your taxable estate and reducing potential estate taxes.

Credit Shelter Trusts (Bypass Trusts) for Married Couples

For married couples looking to reduce estate taxes, a credit shelter trust (CST) (also known as a bypass trust) can be a powerful strategy.

A CST ensures that when the first spouse passes away, their estate tax exemption is fully utilized instead of being lost. The trust fund continues to cover the surviving spouse’s living expenses and other maintenance costs through retirement.

If you’re a married person residing in Washington, talk to your attorney to see if you might benefit from a CST.

There are many different types of trusts. Some are generic while others are best used for very specific purposes, such as for education or the care of a special needs loved one.

Even though irrevocable trusts limit the grantor’s control, they often allow access to funds for essential needs like health, education, maintenance, and support.

Charitable Contributions

Would you prefer donating to charity over paying unnecessary taxes?

Giving to charity, either while living or upon your death, can also reduce estate taxes.

A bequest is a gift upon your death and is typically documented in your will. Both the IRS and the Washington Department of Revenue allow you to reduce your taxable estate by the value of bequests to qualified charitable organizations.

Another option, similar to the irrevocable trust scenario discussed above, is to fund a charitable trust, which can both maximize the impact and value of your gift and minimize your future estate tax liability.

If you are charitably inclined, a proactive giving plan can significantly reduce your lifetime tax bill through strategies like Qualified Charitable Distributions and bunching charitable gifts.

Consult a professional when employing charitable gifting strategies to maximize your impact and your tax-efficiency.

Direct Tuition & Medical Payments

Other ways to give include paying for the medical or educational expenses of another person.

The IRS specifically exempts direct payments to qualified educational institutions and medical providers from the federal gift tax.

As long as the gift is paid directly to a medical or educational institution for someone else’s benefit, no tax is due and it doesn’t require a gift tax return, even if it exceeds the annual gift limit.

If you’re looking to reduce the size of your estate before you pass, consider loved ones who are attending college or accruing medical expenses.

Life Insurance Considerations

Sometimes a taxable estate can include significant illiquid assets, such as real estate or business interests, that a person may want to pass down to family members without them having to be sold.

Perhaps a family home on some farmland has been passed down for generations and is worth $4 million, but the family doesn’t have much cash on hand.

In such a scenario, life insurance can be a useful tool to cover any taxes owed by the estate.

Keep in mind that life insurance proceeds are included in the value of your estate by default, which can add to the tax burden.

To prevent the death benefit from being included in your taxable estate, consider employing an Irrevocable Life Insurance Trust (ILIT). An ILIT works like other irrevocable trusts, ensuring the insurance policy provides liquidity without adding to the estate tax burden.

Advanced Tools

Other advanced estate planning strategies include Family Limited Partnerships and Generation Skipping Trusts:

- Family Limited Partnership (FLP) – For families that own and operate a small business (or multiple small businesses), an FLP offers a tax-efficient vehicle to transfer ownership of that business to kids or other family members without handing over control of the business until the owner is ready.

- Generation Skipping Trust (GST) – A GST allows grandparents to maximize their lifetime generation skipping transfer tax exemption to give assets directly to grandchildren, avoiding estate taxes at both the grandparent’s and parent’s deaths, reducing the family’s tax burden over generations.

The more complex the scenario, the more important it is to engage an experienced estate planning lawyer. Be sure to consult your attorney if you’re considering an FLP or a GST.

Capital Gains on Inherited Property

You probably won’t owe inheritance tax on assets from a loved one who recently passed, but it’s important to plan ahead for future taxes.

General Rules for Inherited Property

One major advantage of inheriting property compared to having it gifted to you is getting a step-up in cost basis.

Let’s say your grandma owns Microsoft stock that she bought 20 years ago for $100,000 and today those shares are worth $1,00,000. Now, as grandma is getting older, she’s trying to reduce the size of her estate so she gives all her Microsoft shares to you.

Then, five years later, you sell the stock for $1,000,000. Because the stock was given as a gift while grandma was alive, your tax basis in the shares is $100,000 and you’ll owe capital gains tax on a $900,000 gain even though the stock hasn’t appreciated since you received it. That’s over $150K in taxes!

Had grandma held onto the Microsoft stock until she died and left it to you in her will, this tax bill could have been avoided!

That’s because your basis in the shares is “stepped-up” to the fair market value on the date of death.

If grandma wants to give a gift, that’s up to her. But if her primary goal is to leave a legacy and help her loved ones out, inheriting appreciated assets is more advantageous than receiving them as a gift.

Selling vs. Holding Inherited Assets

After you’ve inherited assets, there are other taxes to plan for, such as taxes on future capital gains or income tax on interest and dividends received from the portfolio.

When deciding whether to hold or sell assets you’ve inherited, you may consider a number of factors, such as:

- Your personal financial needs and goals – Do you need the funds ASAP? Or maybe you have more flexibility and want to leave a legacy to future generations.

- The type of asset you’ve inherited – if you inherited your parent’s house, for example, and don’t want to manage a rental property or move into it yourself, your decision might be easier.

- Taxes – While you get a step-up in basis at the date of death, you may owe capital gains taxes if the value continues to increase. Or maybe the value has dropped in value since you inherited it and you can take some losses to offset gains elsewhere in your portfolio.

- Market conditions – The economy and market trends can impact your decision. If prices are low, selling might mean getting less than you want. If the market is strong, you might get a better price.

For federal tax purposes, the IRS considers all inherited assets to have been held for longer than a year, so regardless of whether you sell one day after the date of death or five years later, any capital gains will be taxed at the more advantageous long-term capital gain tax rates.

For more guidance on tax planning considerations for inherited assets, take a look at this video:

Washington State-Specific Considerations

We’ve established that while there is a Washington State estate tax, there is no Washington State inheritance tax.

Another state-specific tax to be aware of is the Washington State Capital Gains tax.

This tax is independent from the federal capital gains tax and is assessed on the sale of appreciated assets owned for longer than a year.

The Washington capital gains tax rate is 7%, but the good news is that it only affects a small number of persons residing in Washington.

The state grants every resident a sizable standard deduction of $270,000 (as of 2024), which means you’d need to have over $270K of gains in a single tax year before any tax is due.

Additionally, a number of asset types (such as real estate) that may be taxable at the federal level are exempt from the Washington tax altogether. Ultimately, effective planning can go a long way in reducing your lifetime tax bill.

Deciding When to Sell

Every situation is different and tax laws are constantly changing. Be sure to consult a financial advisor who is familiar with your goals when evaluating the right time to sell.

Other Potential Taxes & Considerations in Washington

Income Tax on Inherited Assets

Although Washington has no state income tax, federal income tax could apply to rental income received from inherited property. Interest and dividend income from an inherited portfolio is also taxable at the federal level.

Property Taxes

If you’ve inherited real estate and plan to keep the property, you’ll also have property taxes to pay going forward.

Property taxes in Washington vary by county and should be considered before deciding to turn an inherited property into a rental to generate income.

The state does offer property tax deferrals and exemptions in limited circumstances. See if you may qualify.

Out-of-State Estate Taxes

Keep in mind that things get more complicated when multiple states are involved. Remember to check the tax laws in the decedent’s home state if you inherit property from outside of Washington.

A Note on Nearby States

Many Washington residents may have property in nearby Oregon or Idaho. Or perhaps you’re considering a move to a neighbor state in retirement.

Oregon – Oregon has both a state income tax and a state estate tax. The estate tax exemption is also the lowest of any state in the country at $1M and the tax rate ranges from 10-16%.

Idaho – Idaho is the only state in the pacific northwest with no state estate tax. Idaho does, however, have a state income tax rate of 5.695%.

Pending or Future Legislation

Washington tax laws are written in pencil, not permanent marker. The State just made sweeping changes to tax policy in 2025 and things are likely to change again in the future.

A proposal that would have repealed the Washington capital gains tax was on the ballot as recently as November 2024 and the state Senate is currently debating a bill that could increase the rate at which property taxes are permitted to rise.

As laws change, so do optimal estate planning strategies. Make sure your financial planner and tax accountant are well-versed on current legislation.

Common Misconceptions & FAQs

No “Inheritance Tax” Means No Death Taxes

Although there is no Washington State inheritance tax, the state estate tax demands careful attention if you’re a person residing in Washington planning to leave money to future generations.

Smaller Estates Don’t Need Planning

Very few people are subject to the federal estate tax due to the high exclusion amounts. Even if you’re below the lower Washington estate tax threshold, however, estate planning is extremely valuable.

Maybe you have kids or grandkids that you want to make sure are taken care of or maybe you have personal property such as a family heirloom that you want passed down. A proper estate plan can help you get these things done.

Out-of-State Issues

A common misunderstanding is that, just because there is no Washington State inheritance tax, you don’t owe any taxes on inherited assets.

If the person you’re inheriting from lived in another state, there’s a chance you may owe taxes to that state.

Is Life Insurance Taxable?

One common question is whether a death benefit paid out by a life insurance policy is taxable. Fortunately, in the vast majority of cases, life insurance proceeds are not taxable.

While life insurance proceeds are included when calculating the size of a taxable estate, the proceeds themselves are not taxable to the recipient if named as a direct beneficiary.

In certain rare scenarios in states with a state inheritance tax, proceeds can be subject to tax, however.

Working with Professionals

Partnering with an experienced team of advisors can help you navigate the Washington estate tax and reduce your tax burden.

Role of Financial Advisors

A skilled financial planner will help you make big decisions while you’re alive, ensuring your loved ones are financially secure and headaches are avoided after you’re gone.

This is even more important in states that have a state estate tax like Washington.

If your parents are aging and you’re expected to handle their estate someday, you should consider sitting down together with their financial planner to make sure there’s a game plan in place.

Estate Planning Attorneys

A financial planner can help shape your overall strategy, but an estate planning attorney is essential for ensuring your wishes are legally protected.

An attorney provides expert legal advice and drafts the necessary estate documents to make your plans official and enforceable. Engaging an estate attorney helps prevent legal complications and ensures your assets are distributed exactly as intended.

Your estate planning lawyer can also give specific guidance on the implementation of complex strategies such as a trust fund or a family limited partnership.

Tax Professionals

Finally, a tax professional, such as a CPA or EA, is crucial for navigating complex tax laws and minimizing your lifetime tax burden. Their value goes beyond simply filing your tax return.

They provide expertise on deductions, credits, and tax planning opportunities while ensuring compliance with ever-changing regulations. Working with a tax professional helps you avoid costly mistakes and optimize your financial decisions for long-term success.

A strong financial team works better together, ensuring no detail is overlooked. By collaborating with a financial planner, CPA, and estate attorney, you get a comprehensive strategy that covers investments, taxes, and legal protections.

This teamwork helps align your financial goals, maximize opportunities, and ensure every recommendation is properly implemented for long-term success.

Our Team Can Assist You Further

Recap of Key Takeaways

There is no Washington State inheritance tax but does have a state estate tax. The Washington estate tax exclusion amount is much lower than the federal exemption threshold and warrants careful planning for those looking to minimize their tax bill.

The federal estate tax threshold is much higher and impacts a small percentage of ultra wealthy people, but legislative changes and evolving tax policy can affect your estate plan.

Other taxes, such as income taxes and taxes on capital gains, can influence your plan for using or investing assets you’ve inherited.

Wondering how to optimize your inheritance or make sure your loved ones will be taken care of?

Our team of CERTIFIED FINANCIAL PLANNERS® and fee-only fiduciaries based in Spokane, WA can help. We serve clients virtually across in the US or in-person at our office.

We collaborate with trusted CPAs and estate planning attorneys to make sure your finances are taken care of and you can focus on enjoying retirement.

If you’re ready to speak with an experienced team of trusted Spokane Financial Advisors, schedule a complimentary call with our team.

If you would like a preview of how our team helps those in retirement make their money last, check out our Youtube channel on stress-free retirement planning.

Additional Washington Estate Planning Resources

Want more resources on estate planning? Check these out:

- Estate Planning Documents: Have you been wanting to get your estate plan in order but unsure of where to start? Here’s a brief overview of the most common documents.

- What’s in a Will?: The foundation of a basic estate plan. What all should be included in your will and what are some things to consider before meeting with an attorney?

- Understanding Powers of Attorney (POA): Wondering who you should name as your POA? What power does a POA have over your finances?

- What is a Trust and How Can it Help Me?: Do you have specific questions on trusts? Read about common trust types and what they might help you accomplish.