Although those first few months of life (and the next 18 years for that matter) can be quite the whirlwind, there are a handful of financial planning tasks that are imperative to complete. In this article, we’ll take a close look at three key financial planning “To Do’s”, and help you evaluate the options available for each item.

How to Prepare for a Baby Financially

We’ll start by discussing updates to your estate plan, and then take a look at getting a jump start on the ever-increasing cost of higher education. We’ll wrap up with a few tax tips, including the net positive task of adjusting your tax withholding to more closely reflect your newly reduced tax bill due to the dependent tax credit. We hope you enjoy today’s short financial checklist as you welcome home your new bundle of joy.

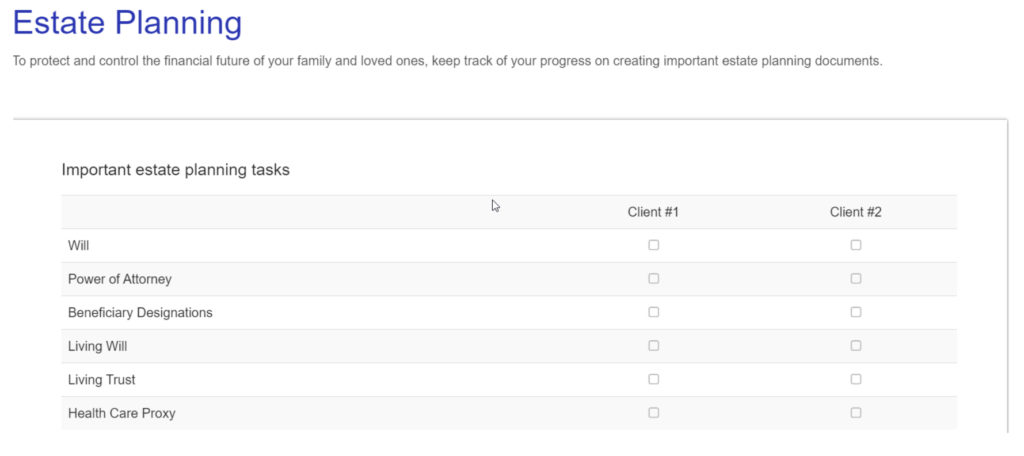

Update Estate Planning Documents

In the event you do not yet have estate planning documents in place, having a child is a great life event to motivate you to take this important step. The following items are an excellent place to start the conversation with your estate planning attorney when planning for your dependents’ needs:

Guardianship

By adding a sub-section in your will about guardianship, you will be able to leave instructions regarding who should care for your dependents in the event of your death. Where will they live? Who will feed them? Take them to school? Clearly stating your wishes for who you believe would be best suited to take this on will not only benefit your kids, but can also help avoid disagreements between your surviving family members. Unfortunately, if you overlook this essential step, your family will be left to make the difficult decision for you.

Consider a testamentary trust

A testamentary trust is a trust that is initially outlined in your will, but is not created until your death. In this event, the testamentary trust can be used to hold your assets until you feel your heirs are old enough, and/or ready to take on this responsibility themselves. The trustee of such a trust is able to manage the funds on behalf of your heirs while they are minors. In fact, depending on your wishes, the trustee can also utilize the funds for the benefit of your heirs while they are still minors. It is important to note, though, that the trustee you select does not necessarily have to be the same person you’ve named as the guardian. Additionally, in the absence of a testamentary trust, a child who inherits assets will have full discretion to use the funds as they will at their age of majority.

Acknowledge the child

In the scenario that this is not your first child and you already have a solid estate plan in place, having an additional child is still a good time to review your existing estate planning documents. More often than not, these will still be in line with your wishes, but it is a good opportunity to verify nothing has become outdated over time. If you are still happy with the plan, a prudent next step is to complete a codicil to acknowledge the child. This new codicil can simply be added to the end of your Will, and it will more clearly make your wishes known for this child just as they do with your other children (who were likely already included by name in the Will) without having to redo the entire document.

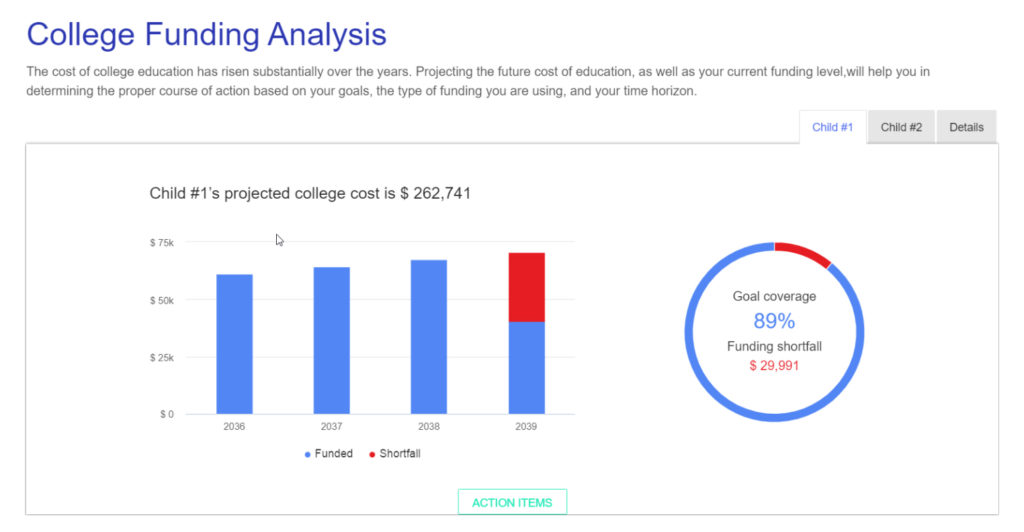

Start a College Savings Plan

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” – Albert Einstein

While the heavy lifting of college savings is accomplished by your conviction to save early and often, there are a variety of vehicles that offer their own pros and cons to reaching your college savings goals when combined with the power of compound interest. The birth of a new child is an excellent opportunity to review your college savings options and investment goals.

529 College Savings Plan

Typically, the first vehicle that comes to mind for college savings is a 529 plan. This is a special type of investment account that is earmarked specifically for paying for higher education in the future. The big benefit to utilizing this type of account is that once you contribute money into it, all the growth then occurs tax free. While this plan has potentially the highest tax benefits, it also comes with strings attached. One factor you do maintain as the account owner, is control. You own the account, not your child, so you maintain control of deciding how the proceeds are used. However, it is critical to note that all proceeds of the account must be used solely for qualified education expenses in order to avoid taxes and penalties.

UTMA/UGMA

The Uniform Transfer/Gift to Minors Act (UTMA/UGMA) is an investment account type that allows you to gift money to your kids. The minor will be the named account owner right out of the gate, but you remain in control of the funds until they reach the age of majority, which varies by state. Since the child is the owner, the first portion of taxable gains in the account is taxed at his/her tax rate which provides an excellent tax advantage to you over time. Eventually, the “Kiddie Tax” does come into play on these accounts, so you will want to work with your advisor on managing these limits. Unlike the 529 Plan mentioned above, the UTMA/UGMA account will automatically become the property of the minor as soon as he/she reaches the age of majority, and can be spent in any manor your child chooses.

Standard Brokerage Account

The last option we will outline is a standard brokerage account. While this option doesn’t come with any tax advantages, it gives you all the control and flexibility. You maintain control of the account as the account owner, and if your child decides they do not need help funding qualified education expenses, you can use the funds as you wish with no penalties.

Take Advantage of Preferable Tax Rules

Having a new addition to the family also means qualifying for new tax benefits. The tax code has built-in advantages for parents to help lessen the financial burden. Next, we will take a look at the tax benefits available for the year 2020.

$2,000 Child Tax Credit

This tax credit allows for a $2,000 swing to your tax bill by listing your child as a dependent on your tax return, regardless of how late in the year they were born. Be sure to adjust your federal tax withholding at work by filing a new W4 with your employer. This monthly increase to your take-home income is a great way to jumpstart your monthly 529 savings!

Flexible Spending Accounts

If you are paying the high price of child care, be sure you are taking advantage of all the options available to you for tax purposes. The best option would be to utilize an FSA or “Flexible Spending Account” if offered by your employer. This account type allows you to avoid federal, state, Social Security and Medicare taxes on your contributions and then use the account to pay for child care expenses.

Child care credit

If you do not have an FSA available, the next best thing is to take advantage of the child care credit on your taxes. You are able to claim this credit if child care is required for you to work. While the amount of benefit varies by your income level, this can be a valuable tool in reducing your tax bill come April.

Conclusion

After getting settled in with your new little one, there are a handful of financial planning “To Do’s” that, when implemented early, can have a lasting positive impact on your family’s financial future. Making sure your estate planning documents are accurate and updated, utilizing the power of compound interest in the style of account that best fits your needs to save for college, and maximizing the tax tools available to you will make sure your child starts off down the right financial path.