Required Minimum Distributions, commonly referred to as “RMD’s” for short, are a fact of life for the typical American retiree. As the country slowly transitioned from retirement benefits consisting of guaranteed payments by pension plans to defined contribution plans (e.g. a 401k), individuals found themselves with a higher level of control over their retirement income. In the wake of this added control came rules and regulations defined by the IRS as to how these retirement savings would be distributed. Hence, RMD rules were born.

In this article, we’ll first dive into the timing surrounding RMD’s and look at how the rules have changed in the tax code over the years. Next, we will examine how each year’s RMD’s are calculated and, in turn, affect your tax bill. We’ll then finish up by taking a look at a few RMD strategies that, when implemented correctly, can have a lasting positive impact on your overall financial plan.

We hope you enjoy this issue of Quantum Insights!

When do I Need to Take RMDs?

There are several key dates that serve as milestones as you transition from your working days to retirement. To name a few: at age 59 ½ you can start withdrawing for your retirement accounts penalty-free, somewhere between age 62 and 70 you can start receiving your social security benefits, and typically the last big date to remember relates to your RMD. Today, your RMD will correspond to your 72nd birthday. This is a fairly recent development, though. This IRS-mandated milestone was only increased from 70 ½ to 72 in December of 2019 upon the passing of the SECURE Act.

While turning 72 years old is the trigger point to remember, your first Required Minimum Distribution is not due that day; it simply will need to be completed in the calendar year for which you turn 72. One caveat to this rule, however, is that the IRS allows a grace period up April 1st of the following year for your first RMD only. This caveat allows those who may mistakenly forget to take their first RMD within the calendar to have a mulligan, without additional penalty. That said, it typically does not make sense to use this caveat purposefully since you will still need to take an additional distribution in that same tax year to satisfy the RMD for your 73rd birthday. This “doubling up of income” effect usually makes delaying your first RMD into the follow tax year unfavorable.

In the case of a missed RMD, the tax penalty is 50% of the RMD amount. The steep penalty makes it especially important to stay on top of your retirement accounts and ensure that your Required Minimum Distributions are being satisfied on an annual basis.

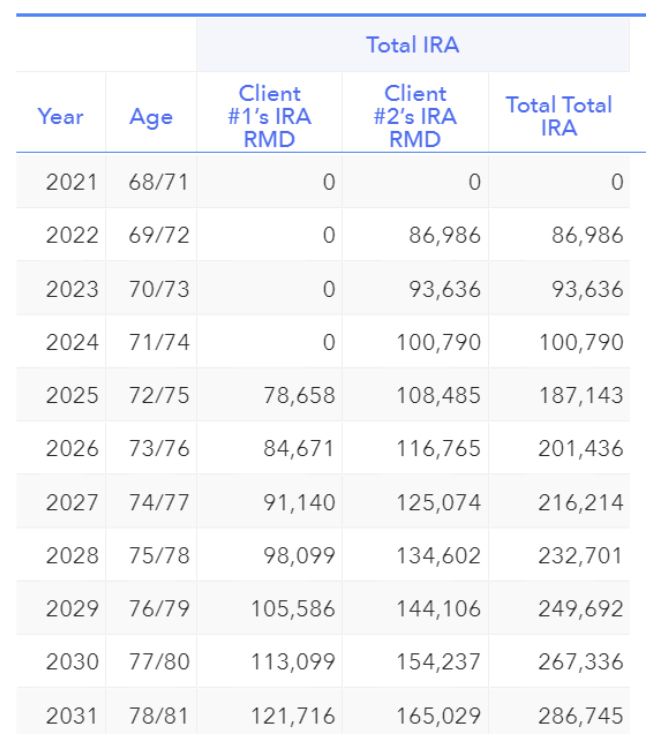

*The above illustration from RightCapital’s financial planning software illustrates the layering of increased taxable income imposed on the financial plan as each client turns age 72.

How are RMDs Taxed?

The first step in analyzing how RMDs are taxed is to identify the dollar amount required to be withdrawn for the year. This calculation can be completed by taking the previous year’s ending value – for example, the value as of 12/31/2020 – for all of your applicable retirement accounts and then applying the year’s RMD divisor per the IRS Uniform Lifetime tables. Keep in mind, each spouse will need to calculate his/her own RMD amount since retirement accounts are always owned individually and are not jointly held.

Your RMD will be taxed as ordinary income at both the federal and state level. This means the same tax schedule that applied to your earned income during your working days will also apply to your RMD’s, with the exception of FICA tax. It therefore often makes sense to have your account custodian withhold federal and state income taxes when you make RMD withdrawals. Not only does this tax withholding count towards your RMD dollar amount for the year, but also, when completed accurately, it allows you to avoid a surprise tax bill from Uncle Sam come April 15th of the following year.

It is important to note that tax-free Roth accounts, unlike tax deferred accounts, are not subject to Required Minimum Distributions during the original account owner’s lifetime. Since tax has already been paid on the funds within these accounts, they are free from any distribution schedules until they are inherited in the future. Given this difference in taxation, concerns about how RMD’s will affect your tax bill are typically limited to traditional account withdrawals which will increase your taxable income in the year of distribution.

RMD Strategies to Optimize Your Financial Plan

While there is no “one size fits all” strategy for handling Required Minimum Distributions there are a handful of strategies that can mitigate and, under certain circumstances, eliminate the tax generated by your RMD.

Strategy #1: Qualified Charitable Distributions (QCD)

The Qualified Charitable Distribution strategy allows individuals who are charitably inclined to utilized their IRA dollars to give on a tax-free basis while still satisfying the RMD needed by their retirement accounts. This strategy can only be completed after attaining the age of 70 ½ and is limited to a maximum annual amount of $100,000 per year. The QCD strategy has become more relevant in recent years as the Standard Deduction was raised significantly (up to $25,100 for Married filing jointly for the year 2021) which took away the tax benefit for charitable giving for a large percentage of tax payers.

Strategy #2: Roth Conversion

It is important to note first and foremost that Roth Conversions do not count towards your Required Minimum Distribution. Instead, the role the Roth Conversion plays in your RMD strategy comes back to how your RMD is calculated. Since your RMD is based on the value of your pre-tax retirement accounts as of the prior year, the goal of the Roth Conversion is to move as many dollars as feasible out of pre-tax retirement accounts and into Roth IRA’s.

It is also helpful to note that you do not need to wait until you’ve started taking RMD’s to start the Roth Conversion strategy. Although the mechanics of this strategy will vary greatly dependent upon your personal cash flow scenario, many times the gap between your retirement date and the year you are forced to start withdrawing your RMD’s is an excellent opportunity to begin implementing the Roth Conversion strategy. While each scenario has its own nuances, the objective of targeting low-income tax years to complete Roth Conversions remains the same.

Strategy #3: Still working? Keep your assets in your active 401k plan

The start date for RMD’s is typically pretty straight forward, but there is one planning strategy around timing that allows for deferral of your Required Minimum Distribution to a later age. If you are working for the entirety of a tax year, the employer sponsored retirement plan associated with that job is not subject to a RMD for that tax year. In other words, if you are over age 72 and are still employed, you will not be forced to make a withdrawal from an account that you are likely contributing to as part of your employee benefit plan.

This strategy can be taken one step further if your employer sponsored plan allows for incoming rollovers. In this case, it could make good sense for you to consolidate other retirement accounts into your current employer sponsored plan, even further limiting the amount you are required to withdraw on.

One caveat to be aware of for the “still working” strategy applies specifically to business owners. Individuals who own greater than 5% of the “still working” company are excluded from this rule and must take their RMD on the balance of the employer sponsored plan.

Conclusion

Required Minimum Distributions play a large role in your retirement income, taxes, and overall financial plan. While age 72 (as of this writing) is the absolute latest your RMD strategy should be addressed, there can be valuable benefits to considering your RMD’s much earlier in your personal financial plan. Although everyone’s scenario is different, planning for and managing your RMD’s amidst the ever-changing tax landscape should be a central discussion in your retirement income planning.