- Washington’s $3,076,000 estate tax exemption (2026) and nation-leading tax rates make proactive planning essential for many residents.

- Without strategies like credit shelter trusts, gifting, and business planning, families may face significant state and federal estate taxes.

- Smart planning can protect your legacy, reduce taxes, and prevent heirs from needing to sell assets to cover unexpected estate costs.

Editor's Note: Effective July 1, 2025, the exemption increased to $3,000,000, and beginning January 1, 2026, Washington now indexes the exemption annually; for deaths in 2026, the amount is $3,076,000.

An estate tax is a tax assessed on the value of everything you own when you die. It can significantly reduce the amount your loved ones inherit.

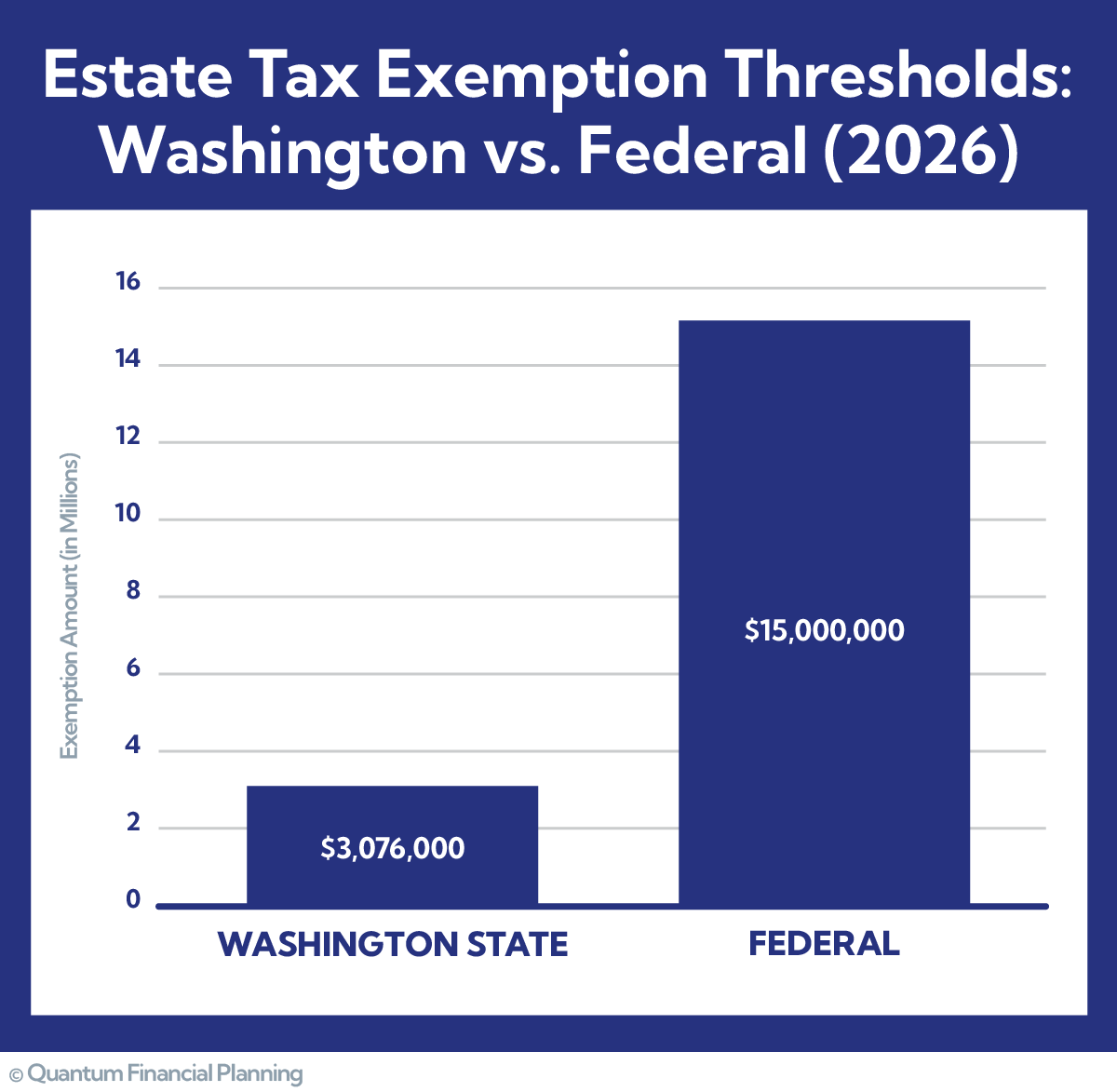

Fortunately, very few people are subject to the Federal Estate Tax. The Tax Policy Center estimated less than 0.2% of those who passed in 2023 had a taxable estate at the federal level.

That was before the One Big Beautiful Bill Act (OBBBA) increased the federal exemption to $15 million per person, which began in 2026.

Washington residents, however, face unique rules that make proactive planning necessary to protect their families and maximize their legacy.

Is There a Washington State Estate Tax?

Yes. Washington is one of the few states with its own estate tax. Effective July 1, 2025, the state raised the exemption to $3 million per person, with annual inflation adjustments beginning in 2026.

While this increase was welcome, the inflation-adjusted exemption of $3,076,000 for deaths occurring in 2026 remains low compared to most states. As a result, more Washington residents may be subject to estate taxes than those under federal law.

In addition, 2025 changes to Washington’s estate tax rates make it one of the most aggressive in the nation.

For Washington residents with assets over $15 million, combined federal and state estate taxes can push the marginal rate above 50%.

This guide provides an in-depth look at the Washington estate tax, including strategies to reduce your tax bill and examples of common estate planning challenges.

For details on estate tax rates and how the Washington estate tax is calculated, see our overview of the Washington Estate Tax.

Understanding the Difference Between Washington State Estate Tax and Inheritance Taxes

The Washington estate tax is often confused with an inheritance tax, where heirs are responsible for payment. In reality, Washington’s tax is paid by the estate before assets are distributed.

Without proper planning, this can force heirs to sell assets just to cover the tax bill before receiving their inheritance.

How the Washington Estate Tax Works

Washington residents can refer to the Department of Revenue for up-to-date information on estate taxes, including the latest exclusion amounts.

Who Actually Gets Hit by the Washington Estate Tax?

Effective July 1, 2025, the Washington estate tax exemption was set at $3,000,000 per person and is adjusted annually for inflation; for deaths occurring in 2026, the exemption is $3,076,000.

Any resident whose net worth exceeds $3,076,000 on their date of death (for deaths occurring in 2026) may be subject to the tax.

While most Washingtonians fall below this threshold, many can quickly surpass it once business interests, real estate, and retirement accounts are included.

Progressive Tax Rates

Washington’s estate tax is progressive, meaning the rate increases as the estate’s value grows.

Updated in 2025, the tax starts at 10% and rises to 35%, the highest top rate in the nation.

Federal Estate Tax Rules Still Apply

Washington residents are also subject to federal estate tax rules. Starting January 1st, 2026, the federal estate tax exemption is $15 million per person, and it will increase slightly each year to keep up with inflation.

This means Washington residents with estates worth more than $15 million may owe both state and federal estate taxes.

Washington-Specific Planning Gaps to Know

Beyond the lower exemption and different tax rates, Washington’s estate tax has several key differences from the federal system.

No Portability in Washington

Under federal law, a surviving spouse can use portability, which lets them apply any unused portion of their partner’s exemption to their own estate.

Washington does not offer this option at the state level. Without careful planning, that can lead to extra taxes.

Example:

Bob and Mary live in Washington and have $5 million in total assets ($2.5 million each). When Bob dies, he leaves everything to Mary. Bob’s estate owes no tax because of the unlimited marital deduction.

However, Mary now has a $5 million estate on her own. If she passes away later with the same amount, her estate will face significant state tax.

For many married couples, this situation can be avoided with a Credit Shelter Trust (also called a Bypass Trust).

Community Property and Basis Step-Up

Washington is one of nine community property states in the country. This means that any assets acquired during a marriage are considered equally owned (50/50) by both spouses.

For estate planning purposes, this can be very beneficial for Washington couples. Community property laws allow joint assets to receive a full step-up in basis when one spouse passes away.

In most other states, only half of the property receives this adjustment. This means the surviving spouse can sell certain assets with little or no taxable gain.

Out-of-State Property

Another factor to consider is how out-of-state property is treated for estate tax purposes.

Many Washington residents own property in other states. In these cases, the estate goes through a process called apportionment, which determines what portion of your estate is taxable in Washington and what portion is excluded.

Key Considerations When Inheriting Property in Washington State

Inheriting property can be both a blessing and a challenge. If you’re receiving part of a large estate, or serving as an executor, here are some key things to know.

Step-Up in Basis

When you inherit property, the IRS lets you “step up” its cost basis to the fair market value on the date of the owner’s death.

This is important because it can significantly reduce taxes when you sell the property.

For example, if your parents bought a home for $200,000 and it’s worth $800,000 when you inherit it, your new cost basis becomes $800,000. If you sell it soon after for that same amount, you’ll owe no capital gains tax.

Without this adjustment, you’d be taxed on the $600,000 gain. Understanding the step-up in basis helps families preserve wealth and pass more to the next generation.

📈 View Our Step-Up in Basis Illustration → This quick visual shows how the step-up rule works and why it can save you or your heirs thousands in taxes.

Potential Costs of Inheriting Assets

When you inherit assets, you may also take on the costs and responsibilities that come with them. Real estate, for example, may require ongoing expenses that can add up quickly, such as property taxes, insurance, maintenance, and repairs.

Retirement accounts such as 401(k)s and IRAs can also create unexpected tax bills.

Withdrawals are taxed as ordinary income, often during a beneficiary’s peak earning years. In addition, these accounts must usually be emptied within 10 years, which can push heirs into higher tax brackets and trigger what’s often called a “tax bomb.”

→ Learn more about the 10-year withdrawal rule.

Disputes between heirs or a contested probate process can add legal costs and delay access to funds. Even when no one goes to court, family disagreements are common after a loss.

Understanding these potential costs helps you plan ahead, avoid surprises, and decide whether keeping or selling inherited assets makes the most sense.

Probate and Serving as a Personal Representative

Washington residents are fortunate that the probate process (the legal procedure for settling an estate) is generally straightforward and affordable.

However, there are still costs involved, including court filing fees, attorney fees, tax filings, and other administrative expenses. These costs can rise significantly if the estate becomes contested.

The personal representative (or executor) handles most of these duties. Their responsibilities include distributing death certificates, closing accounts, settling debts, filing taxes, and ensuring that remaining assets are transferred according to the will.

It can be a demanding job, but Washington law allows executors to receive compensation for their work.

Why Washington’s Estate Tax is Only One Piece of the Puzzle

When creating or reviewing your estate plan, it’s important to consider other taxes that may apply beyond the Washington estate tax.

Federal Income Tax

Some assets can trigger federal income taxes, which can surprise beneficiaries if they aren’t prepared:

- Pre-Tax Retirement Accounts: Withdrawals from inherited IRAs are taxed as ordinary income, which can push beneficiaries into higher tax brackets.

- Income-Producing Real Estate: Rental properties often make sense to pass down due to the step-up in basis received at date of death, but they can generate ongoing taxable income, so plan for reporting and paying federal income tax each year.

- Family Businesses: Inheriting a business can create a new stream of taxable income, along with management, bookkeeping, and other responsibilities associated with business ownership.

Understanding how each asset is taxed helps you avoid surprises and plan efficiently.

Federal Capital Gains Tax

While inherited assets receive a step-up in basis at death, any future growth is still subject to capital gains tax when sold.

If you keep appreciating assets, such as a stock portfolio or real estate, those gains can build over time, potentially leading to a big tax bill later.

Planning for when and how to sell can help mitigate this future tax liability.

Washington State Capital Gains Tax

Washington recently implemented its own state capital gains tax. While many states already tax capital gains, this change adds another layer of complexity for Washington residents.

Similar to the discussion above on the federal capital gains tax, those who inherit appreciating property and choose not to sell right away in favor of long-term growth should be aware that future growth could be taxed.

Estate Planning Strategies to Minimize Taxes for Washington Residents

Give While You’re Living

For many people, the simplest way to reduce estate taxes is to give money away during your lifetime.

The annual federal gift tax exclusion is $19,000 per person in 2026, and will increase over time with inflation. This means you can give up to $19,000 per person each year without triggering any federal gift tax reporting.

For example, if you have three children, you can give each of them $19,000 per year under current federal rules. If you’re married, both you and your spouse can make these gifts.

That means you could transfer up to $76,000 per year ($19,000 × 4) to your children and their spouses, completely tax-free.

Gifting isn’t limited to family. If you plan to leave money to a friend or neighbor, giving during your lifetime can also lower your estate’s value and future tax bill.

Unlimited Gifts for Medical and Tuition Expenses

There are two ways to give beyond the $19,000 annual limit: paying qualified medical or tuition expenses directly to the provider. These payments don’t count toward your annual gift exclusion or lifetime gift exemption.

Superfunding a 529 Account

If you want to help with education costs, consider “superfunding” a 529 college savings plan. The IRS allows you to contribute up to five years’ worth of annual gifts at once (that’s $95,000 per beneficiary under current rules) without triggering gift tax.

This strategy moves money out of your taxable estate immediately and lets it grow tax-free, ensuring more of your wealth supports education rather than estate taxes.

Use Trusts Strategically

Trusts aren’t necessary for everyone, but they can be powerful estate planning tools.

- Revocable Living Trusts allow assets to pass to heirs without probate while keeping control during your lifetime.

- Irrevocable Trusts move assets—and their future growth—out of your taxable estate, but they can’t be changed once established.

Learn more about revocable vs. irrevocable trusts.

Common Trusts Used in Washington Estate Plans

Credit Shelter Trust (Bypass Trust)

A testamentary trust created at death to help married couples fully use each spouse’s Washington estate tax exemption ($3 million in 2025; $3,076,000 for deaths occurring in 2026 due to inflation indexing).

Credit Shelter Trusts help solve the portability issue mentioned earlier.

📊 View Our Credit Shelter Trust Illustration → See how a CST can preserve both spouses’ Washington estate tax exemptions and reduce the overall tax bill for your heirs.

Trusts for Minor Beneficiaries

When leaving money to a minor, it’s best to do so through a trust and name a trustee to manage distributions. Without a named trustee, the court will appoint one during probate.

Irrevocable Life Insurance Trust (ILIT)

Although life insurance proceeds aren’t taxable to beneficiaries, they are included in your gross estate. Having a trust own the policy keeps the death benefit outside your estate, reducing taxes.

Small Business and Real Estate Planning Opportunities

Estate planning can be more complex for Washington residents who own businesses or real estate.

These assets are often valuable but not easily sold, which can create liquidity issues when paying estate taxes. Without planning, heirs may be forced to sell assets to cover taxes.

Fortunately, several strategies can help:

Family Limited Partnerships (FLP)

An FLP is a family-owned entity that holds business or investment assets. Parents can use an FLP to transfer ownership to children at a discounted value while maintaining management control.

Special Use Valuation and Valuation Discounts

The IRS lets qualifying farms or closely held business property be valued based on how they’re currently used instead of their fair market values. This can significantly lower the taxable value of the estate, reducing estate taxes. Families can also apply lack of control discounts when gifting minority interests in a closely held business.

Estate Tax Deferral (Section 6166 Installment Plan)

If a closely held business makes up at least 35% of the gross estate, both Washington State and the IRS allow the estate to defer payment of estate taxes. The estate can make interest-only payments for four years after death, then pay the remaining balance over as many as ten additional years. This can give heirs time to pay the tax without liquidating business assets.

📑 Explore Our Family Business Succession Planning Guide → Learn how to create a smooth transition plan, protect family ownership, and minimize estate taxes so your business can thrive for the next generation.

Charitable Giving

For those who are charitably inclined, donations made upon death (called charitable bequests) are fully excluded from your taxable estate.

There’s no limit to how much you can give, as long as the recipient is a qualified charitable organization granted tax-exempt status by the IRS.

Charitable Trusts

A charitable trust lets you benefit both your loved ones and your chosen charity. You can fund it during your lifetime or through your estate.

Charitable Remainder Trust (CRT)

Provides income to you or your beneficiaries for a set term (or for life), with the remaining assets passing to charity at the end of the trust term.

Charitable Lead Trust (CLT)

A CLT works in reverse from a CRT. The charity receives income for a set number of years, and at the end of the term, the remaining assets pass to your heirs, often at a reduced gift or estate tax cost.

3 Washington Estate Planning Case Studies

Case Study #1: How One Widow Reduced Her Tax Bill and Increased Her Giving

Client Snapshot

- Age: 85

- Marital Status: Widowed

- Federal Income Tax Bracket: 32% (expected to drop to 24% in two years)

- Estimated Net Worth: $4M ($5M projected at death)

- Primary Concerns: Financial flexibility, charitable giving, minimizing taxes

Key Challenges

The client wanted to leave at least $2 million to her two sons while keeping financial flexibility and supporting friends and charities during her lifetime.

Because no credit shelter trust was created when her husband passed, she faced a potential $2 million taxable Washington estate. In addition, her investments had a low cost basis, meaning selling them would trigger significant capital gains and net investment income taxes.

Planning Strategies Used:

📌 Gifting Appreciating Stock to Grandkids

She gifted stock shares instead of cash to her four grandchildren, three of whom are in very low tax brackets (12% or less). They can sell the shares with little or no capital gains tax, saving her over $5,000 annually compared to selling the shares herself.

📌 Qualified Charitable Distributions (QCDs)

She redirected required minimum distributions (RMDs) she didn’t need to charities directly, avoiding income tax on those amounts and lowering taxable income in her later years.

📌 Donor Advised Fund (DAF)

By contributing $40,000 of appreciated stock this year and again next year, she front-loaded ten years of charitable giving. This strategy maximized deductions in her highest income years, cutting both income and capital gains taxes.

📌 Annual Gifting

She also gives the maximum annual exclusion amount ($19,000 per recipient under current rules) to her two sons, their spouses, and two friends, removing at least $114,000 from her taxable estate each year.

Results and Impact:

✅ Tax Savings

Over $30,000 in federal income taxes saved across two years, plus $5,000 annually in capital gains, and a projected $150,000 reduction in Washington estate tax.

✅ Wealth Transfer

More than $1 million transferred tax-free during her lifetime.

✅ Maximum Impact

Reduced taxes allowed her to give more to the people and causes she loves.

Key Takeaway

By combining smart gifting with charitable planning, this widow cut her tax bill by hundreds of thousands of dollars and ensured more of her wealth will go to people and causes she cares about.

Case Study #2: Couple Protects Family Business and Cuts $600K in Estate Taxes

Client Snapshot

- Ages: Early 60s

- Marital Status: Married

- Estimated Net Worth: $25M (and growing)

- Family: Two children

- Primary Concerns: Protect the family business, reduce estate tax liability, preserve wealth for kids, and avoid probate for privacy

Key Challenges

This high-net-worth couple had a growing estate that far exceeded Washington’s $3,076,000 estate tax exemption for deaths occurring in 2026 and the $15M federal exemption. A large portion of their wealth was tied up in closely held business and real estate holdings, creating liquidity and privacy risks. Their simple will and unfunded trust left them exposed to probate and high estate taxes.

Planning Strategies Used:

📌 Family Limited Partnership (FLP)

Consolidated business and real estate assets, enabling gradual transfers to children while applying valuation discounts and maintaining control.

📌 Valuation Discounts

Used lack of control and marketability discounts to transfer business interests at about 75 cents on the dollar.

📌 Irrevocable Life Insurance Trust (ILIT)

Moved a $2M life insurance policy outside the estate to prevent inflating the taxable estate and paying an additional $600K in estate taxes.

📌 Revocable Living Trust

Funded and updated to ensure assets could transfer smoothly outside probate.

📌 Lifetime Exclusion Gifts

Used federal exemptions to transfer assets during life, removing future growth from the estate and significantly reducing the portion of the estate subject to Washington state taxes.

📌 Asset Sequencing

Liquidated high-basis assets for spending and preserved low-basis assets to pass on with a step-up in basis at death.

Results and Impact:

✅ Washington Estate Tax Savings

Reduced their projected state estate tax bill by over $600,000 while removing future growth from their taxable estate.

✅ Maintained Control

Continued to manage business operations while transferring ownership at discounted values.

✅ Privacy and Legacy

Avoided probate and moved life insurance outside the estate, protecting privacy and preserving liquidity.

Key Takeaway

Through FLPs, ILITs, and valuation discounts, this couple saved $600K in Washington estate taxes, maintained control of their assets, and secured their family’s legacy.

Case Study #3: Retiring Couple Creates Fair Plan for Kids While Preserving Land

Client Snapshot

- Ages: Early 70s

- Marital Status: Married couple

- Federal Income Tax Bracket: 12%

- Estimated Net Worth: $8M (land, IRAs, and other assets)

- Family: Two children

- Primary Concerns: Managing inherited land and retirement assets, fairness between children, flexibility for retirement

Key Challenges

This couple inherited over $2 million in land across Washington and Idaho, plus a $700,000 IRA. Their $8 million estate was at risk because no Credit Shelter Trust was in place and a former advisor missed opportunities to reduce capital gains taxes.

They also wanted an estate plan that was fair, since one child was local and experienced with real estate, and the other was not.

Planning Strategies Used:

📌 Credit Shelter Trust

Ensured both spouses’ Washington estate tax exemptions would be fully utilized.

📌 Capital Gains Harvesting

Shifted from loss harvesting to gain harvesting, gradually stepping up basis and lowering future taxes.

📌 Retrospective Appraisal

Obtained an appraisal dated to the parents’ death, securing a higher stepped-up basis and saving over $60,000 in taxes.

📌 Roth Conversions

Converted pre-tax retirement assets while in a 12% bracket to Roth IRA, creating long-term tax savings for heirs.

📌 Strategic IRA Withdrawals

The clients withdrew inherited IRA proceeds in the same tax year of major business expenses. This reduced future exposure to federal income tax on their inherited account.

Results and Impact:

✅ Reduced Capital Gains Taxes

Cut taxable gains by $300,000, saving $60,000+ in taxes.

✅ Tax-Efficient Retirement Accounts

Locked in today’s low rates, ensuring heirs avoid future higher brackets.

✅ Flexibility and Fairness

Used the trust and a clear liquidation plan to balance inheritance, fund retirement, and preserve family land.

Key Takeaway

Through smart timing and estate structuring, this couple eliminated projected Washington estate taxes, saved over $60K, and built a fair, lasting plan for their children.

Common Mistakes to Avoid With Your Washington Estate

Forgetting to Fund a Trust

Creating a trust is only the first step. If you don’t transfer assets into it, the trust won’t work as intended. An unfunded trust can lead to probate, higher costs, and lost tax benefits.

Waiting Too Long to Act

Estate planning strategies work best when you start early. Waiting can limit your options and increase tax exposure. If you think you’re too young to start thinking about these things, you’re wrong.

Assuming the Federal Exemption Is Enough

Washington’s estate tax exemption amount was $3,000,000 in 2025 and is $3,076,000 for deaths occurring in 2026 due to inflation indexing, far below the federal level. Many families who don’t owe federal estate tax are still hit with a substantial Washington tax bill.

Ignoring Double Taxation of Retirement Accounts

Pre-tax retirement accounts like IRAs or 401(k)s can be subject to both federal income tax and Washington estate tax. Without proper planning, heirs may lose a significant portion of these accounts to taxes.

How do I know if my estate will owe Washington estate tax?

If your estate is worth more than $3,076,000 (the Washington estate tax exemption for deaths occurring in 2026), it may owe state estate tax. A financial planner or estate attorney can help estimate your estate’s value and recommend strategies to reduce or offset potential taxes.

Can life insurance increase my Washington estate tax liability?

Yes. While life insurance proceeds aren’t taxable as income, they are included in your estate’s total value for Washington estate tax purposes.

An Irrevocable Life Insurance Trust (ILIT) can move the policy outside your estate so the death benefit isn’t subject to tax.

What happens if I own property in another state?

When Washington residents own property in other states, the estate goes through a process called apportionment to determine what portion is taxable in Washington.

Does Washington’s estate tax apply to retirement accounts?

Yes, qualified retirement accounts (IRAs, 401(k)s, etc.) are included in your taxable estate. Since heirs must also pay income tax on withdrawals, these accounts can face double taxation without careful planning.

How can I reduce my Washington estate tax bill?

While we have worked with many clients to effectively reduce their Washington estate tax liability, every legacy plan is unique.

Strategies like credit shelter trusts, lifetime gifting, and charitable giving can make a big difference, but the best results come from working with a coordinated team of professionals who can tailor an estate plan to your family’s specific needs.

When should I use a trust to avoid estate tax?

Trusts typically start to become useful once your estate surpasses Washington’s exemption limit. Since they usually require giving up some control in exchange for tax savings, it’s important to work with a professional to design a plan that fits your family’s needs.

What should I do with my highly appreciated stock?

Instead of selling and triggering capital gains, you might consider gifting shares to family in lower tax brackets or donating to charity through a Donor Advised Fund. Both strategies reduce your taxable estate and minimize taxes.

Can Roth conversions help reduce my estate tax burden?

In many scenarios, Roth conversions can lower your taxable estate value which, in turn, can reduce your Washington state tax bill. It’s worth noting, however, that Roth conversions are treated as taxable IRA distributions by the IRS and subject to federal income tax.

How do I avoid probate in Washington?

You can avoid probate on certain assets by funding a revocable living trust, using transfer-on-death deeds, or naming beneficiaries directly on accounts. These steps allow assets to pass straight to heirs without court involvement.

That said, most families still use a pour-over will to capture any assets that weren’t moved into the trust before death. Because of this, it’s rare to avoid probate entirely, but proper planning can limit how much of your estate goes through the process.

When is life insurance a smart way to cover estate tax?

Life insurance can provide liquidity to pay estate taxes when much of your wealth is tied up in real estate or business assets and you don’t want your heirs to be forced to sell these assets to pay taxes. Placing the policy in an ILIT can help make sure the death benefit isn’t added to your taxable estate.

What is a credit shelter trust, and how does it help?

A credit shelter trust, also commonly known as a bypass trust or an A/B trust, allows married couples to maximize both spouses’ full estate tax exemptions. In Washington, this can protect up to $6,152,000 for deaths occurring in 2026 (representing two inflation-adjusted exemptions of $3,076,000 per spouse).

Washington’s Estate Tax Calls for Specialized Planning and a Qualified Team

Washington’s estate tax is complex, with rules and thresholds that differ significantly from federal law.

Navigating strategies like trusts, gifting, Roth conversions, and business planning requires a coordinated approach.

Working with a team of professionals ensures your plan is tailored to your family, preserves more of your wealth and protects your legacy for future generations

Ready to Start Planning?

Our team of CERTIFIED FINANCIAL PLANNERS® and fee-only fiduciaries based in Spokane, WA can help. We serve clients across the U.S. or in-person at our office.

We collaborate with trusted CPAs and estate planning attorneys to make sure your finances are taken care of and you can focus on enjoying retirement.

If you’re ready to speak with an experienced team of trusted Spokane Financial Advisors, schedule a complimentary call with our team.