Time, temperament, and talent—the three T’s that are required to succeed at anything.

One of my mentors taught me this acronym early in my financial planning career, adding that if someone can’t do one of the three T’s well, they should consider delegating the task to someone else.

The application you are probably most familiar with regarding this concept is the dreaded FSBO, or “for sale by owner.”

As you surely know, the data says that FSBO homes sell for 26% less than agent-assisted transactions.

Yet despite the statistics, homeowners, who likely lack one of the three T’s, continue to attempt managing the sale in a DIY manner of what is likely their biggest asset.

And just as homeowners try to FSBO their house, I’ve found that many top-producing real estate agents FSBO their financial plan.

Do you have all three T’s needed to manage your personal financial planning?

Financial advisors likely hear some of the same reasons you do for why a Realtor© would want to FSBO their financial plan:

- “I don’t want to pay for it.”

- “I had a bad experience with another professional who did not deliver any value.”

- “I have a friend who will handle it for me for free.”

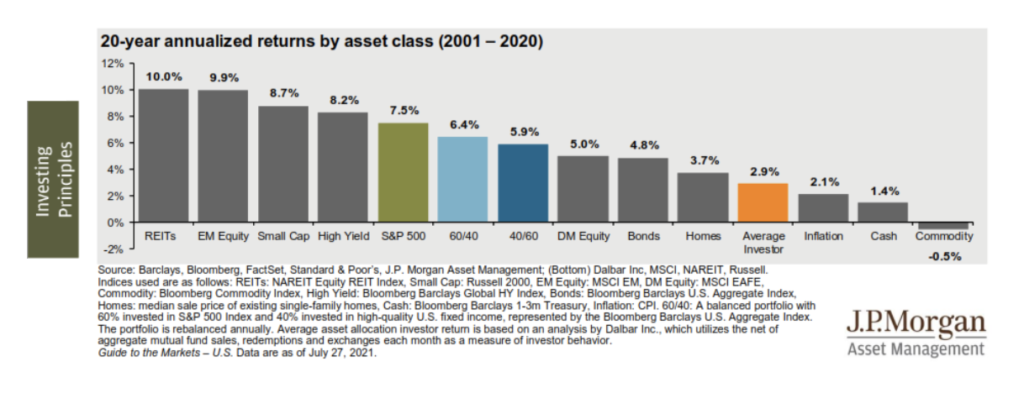

But when it comes to financial planning, the data largely falls in line with the data from real estate transactions. According to JPMorgan (shown below), the returns for various investment types over the past 20 years exceed the returns by the average investor. This situation is like the unfavorable outcome of a FSBO transition not handled by an experienced real estate agent.

So, if you are looking for some talking points as to why a potential client should list with you instead of going the FSBO route, there are some great statistics you can check out here. And a handful of those concepts may apply directly to your personal financial planning.

1. You Have a Lot on the Line

Top Producers have a huge impact on their community by helping individuals navigate what is likely their life’s biggest purchase. Due to the high level of responsibility that comes with the job, Top Producers are compensated accordingly.

However, having a high income does not guarantee financial success. In fact, far from it.

Although generating income to invest in the first place is certainly step one, if you’re not making savvy money decisions with your high-commission income, the result could leave you with the same net worth as when you started finding success.

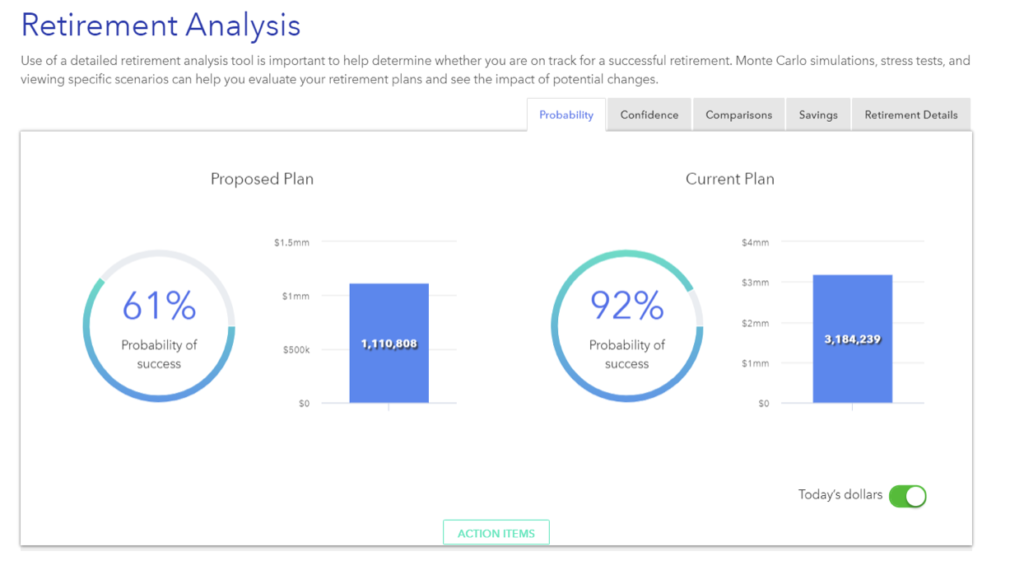

Source: Sample snapshot taken from RightCapital financial planning software.

The good news is you are not the first Top Producer needing to invest for their future!

And even better news: There is someone who has helped Top Producers figure it out before!

2. A Successful Process Is Key

Process is everything.

In a recent blog post, real estate coach Tom Ferry outlines 12 Defining Traits that Separate Real Estate “Professionals” from Real Estate “Hobbyists.” Trait #5 says:

“They are knowledgeable about the process and know how to guide clients successfully through real estate transactions” —Tom Ferry Blog

In the same way, successful financial planners have a defined process. And it can deliver massive value to Top Producers.

One key element to look for in a financial planner is their credentials—specifically, a CERTIFIED FINANCIAL PLANNER™ mark. CFP® professionals have been trained to follow a specific financial planning process. Although it will likely be tailored to your specific needs, it helps ensure that all the i’s are dotted and t’s are crossed in your financial plan.

So, what is the Quantum Process? It entails five big things that are important to top-producing real estate agents:

- Get organized. Just like staging a home, a good financial advisor will organize your financial life in a manner that allows you to fully understand where you stand, as well as what’s possible.

- Visualize your goals. As with starting a home search, we start with your goals for success in mind.

- Make a plan. Just like a successful marketing plan, your financial plan will incorporate many avenues for review, not just your investment accounts.

- Optimize the plan. Just like running a CMA, your financial plan will need a tweak here and there to fine-tune your long-term trajectory.

- Systematically review and adjust. As with a listed property, you need to be flexible and adjust on the fly. Your planner’s expertise can help you adjust your plan when life throws you a curveball and maximize your success when an opportunity presents itself.

3. Your Time Is Better Spent on Your Business

We are big advocates for maximizing your time by freeing you to focus on the activities that require your highest and best use of time.

Seth Godin put it well in a blog post titled “Efficient or Productive?”:

“Productive is the skill of getting the right things done, so that we accomplish what we set out to do in the first place. The work that matters.” —Seth Godin

While you very well may have the temperament and talent to successfully manage all aspects of your financial plan, does it make sense for you to spend your time there?

And do you have the tools readily available to productively achieve the task?

A successful financial planner has access to tools that effectively monitor both your portfolio and financial plan in real time—allowing the advisor to productively manage what you might not be able to on your own.

Imagine managing a real estate transaction without access to the MLS or your CMA software.

4. Advisors Have Access to a Network You May Not

You get a call four days before closing and your client’s financing now requires a roof certification to close the deal. Who do you call?

You likely have a handful of names that come to mind and can send your client their contact info from your CRM within a few minutes.

This niche network and knowledge base are worth their weight in gold when you are at the finish line of a closing.

Similarly, a successful financial planner will have a network of professionals on call and ready to handle a curveball when needed.

Although a full-service financial planner will quarterback the many areas of financial planning you require, they also depend on a team of professional experts to step in from time to time.

Here are a few areas to expect great referrals for implementation from your financial planner:

Insurance: Although some financial advisors carry insurance licenses, many choose to remain fee-only. By referring you out to purchase an insurance policy, they avoid any conflicts of interest involved in a commission-based sale.

Estate planning: While your financial planner should request copies of all your estate planning documents, organize them, and assess whether they are in line with your goals, your advisor is not an attorney. Having a rockstar estate planning attorney on your professional team is a must, especially for Top Producers with a more complex net worth statement.

Tax planning: Collaboration between your financial planner and CPA is a must and can prove to be a powerful team in your corner.

Your clients don’t expect you to be the one inspecting the roof, but they do expect you to connect them with the right person for the job.

5. We Can Be Blind to the Flaws in Our Own Plan

How many times when previewing a listing’s photos have you witnessed some out-of-touch thoughts about the state of the home?

- Carpet from the ‘70s? “Vintage.”

- Appliances on their last leg? “Quality.”

- Landscaping that’s been neglected? “Natural.”

Let us give you the financial planning version:

- Estate planning documents? “We have thought about it, at least!”

- Investment allocation? “We set that up a long time ago—we like to buy and hold.”

- Diversification of net worth? “We will get more diversified once we retire.”

Having a fresh set of trained and unbiased eyes can reveal some glaring holes in your financial plan.

And please don’t feel bad about this—it is human nature! We are simply unable to see our situations without the lens of our experiences that got our finances to where they are today.

6. Financial Advisors Have Experience with Your Exact Situation

Your proven experience in your niche market is one of your biggest competitive advantages over your peers and likely one of the biggest reasons your clients seek you out.

There is likely a neighborhood, lake, or community that you know better than anyone else. Compared with your Top Producer peers who have found success in other areas, anyone in that specific market would be crazy not to work with you.

The same is true for financial advisors.

Helping an investor purchase an office building is different from helping a California transplant buy a lake home.

Similarly, helping tech employees navigate their stock options and transition to retirement is different from helping a Top Producing Realtor© manage their variable income, model their real estate investments, and balance their net worth.

As a result, Quantum has built a specialized financial planning process with Top Producers’ biggest needs in mind. Here are a few areas where we help Top Producers succeed most:

- Commission income management

- Rental real estate modeling

- Debt and mortgage analysis

- Net worth concentration review

- Retirement contributions optimization

- Goal setting and retirement planning

Working with an advisor who has expertise in your situation as a top real estate professional can give you confidence that you’re able to enjoy the lifestyle you’ve worked hard for while building toward your goals.