Hey there, Top Producers. This is Jordan Curnutt, your Realtor-specific CERTIFIED FINANCIAL PLANNER™ professional. Today I want to talk about what could be your biggest competitive advantage in building your net worth as a top-producing real estate agent.

So the competitive advantage that we’re talking about for Top Producers building their net worth is investing in real estate. Really, we think this comes down to two main categories for why this is a competitive advantage for you as opposed to the average person out there. And the first one is just your market expertise.

You know your niche market of Spokane. Whether it’s up north, out in the valley, lakeside property, a specific gated community, you know that area better than anyone else. And that’s why your clients know they have to call you—because you’re the best one for the job when a transaction is to occur in that specific area.

So as you see deals pop up, and if you can identify an imbalance in the market, given your niche expertise, we see that as a huge competitive advantage for Top Producers and an ability to build your net worth that the average person just doesn’t have access to.

The second component to this is just your ability to transact those deals at a reduced cost as compared to the average person. Your ability to have a 3% head start, whether it’s on the buy side or the sell side, and building that sweat equity of running that transaction as compared to the average person who’s coming to you and hiring you to manage that transaction and leverage your expertise for them. Again, that’s a huge competitive advantage when it comes to real estate investing as a Top Producer in Spokane, Washington.

One thing that’s good to mention and to acknowledge is there are over 2,000 real estate agents in Spokane. They all have that same ability to implement their sweat equity, to do a transaction at a reduced cost, and many of them have their own niche expertise as well. So if you’re looking for, what are ways beyond the two that we’ve already addressed to leverage your expertise as a Top Producer in Spokane, the next piece of that equation is to really lean into the numbers.

Building your Net Worth as a Top Producer

One of the biggest financial advantages for top-producing real estate agents is their ability to leverage their market expertise.

Given their career experience and positioning, Top Producers have the opportunity to build their net worth in ways the average investor cannot. Two factors drive this reality: the ability to identify opportunities and to reduce transaction costs.

Identifying an Opportunity

The ability to use your niche knowledge base to identify a real estate opportunity or inefficiency gives you a competitive advantage.

The residential investment property market comes with unique challenges, sometimes making the use of financial calculations, like cap rates, less valuable for identifying a potential deal.

This is because supply and demand characteristics drive the residential market more than the commercial space.

Alongside investors, individuals looking for their own personal residences are in the buyers’ pool for single-family homes. This causes far more competition for investors than just other investors looking at cap rates alone.

The competition means that someone may be willing to “overpay” for a residential property, forcing the cap rate down to an unattractive place from an investor standpoint.

Luckily, you are an expert with your CMA software. This will likely be your most productive tool in identifying the price a property will reasonably sell for, and you can utilize the financial calculations from there.

Reducing Transaction Costs

The second driving factor giving you an edge over the average investor is the ability to execute the transaction for a reduced cost.

Since you obviously will not require compensating a buyer’s agent to handle the deal for you, your sweat equity of 3% of the purchase price gives you a leg up at buying the property for a discount.

Furthering Your Competitive Advantage

Great news: You’re ahead of the game as the most qualified person to identify an inefficiency in your niche market and are uniquely positioned to capitalize on real estate investments through reduced costs.

But how can you further your competitive advantage compared with the other 2,000 licensed Realtors in Spokane?

Lean into the Numbers

Let’s look at two valuable metrics for evaluating a potential opportunity and then wrap up with how investing in real estate may or may not be the right fit for your overall financial plan.

Cap Rates

Cap rates are probably the most well-known metric for evaluating a rental real estate investment property, but they also come with limitations.

What Are Cap Rates and What Do They Tell Us?

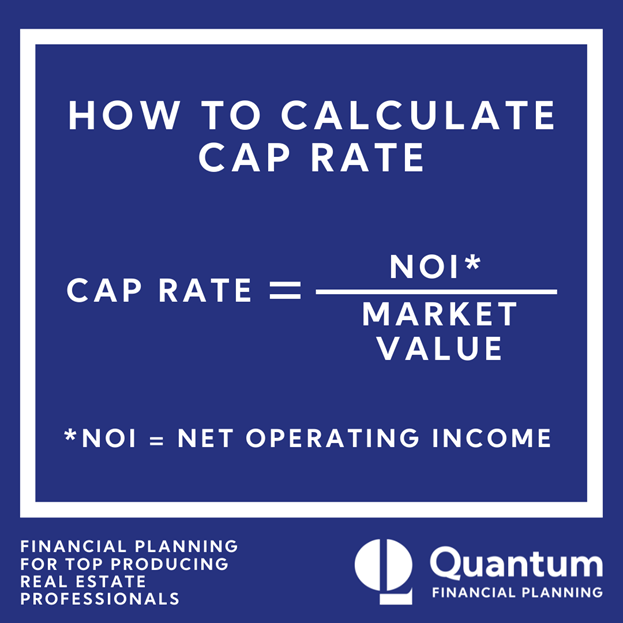

Cap rate, short for “capitalization rate,” is a metric that calculates the relationship between the annual income generated from a rental property and the value of the property.

The higher the income generated versus the market value, the higher the cap rate.

Because of this relationship, you are shooting for the lowest cap rate possible when selling an investment property since this will demand the highest sales price.

Inversely, when purchasing an investment property, you would look for the deal with a higher cap rate. This indicates you could pay less for the property, given the amount of cash flow that it will generate.

Cap Rates and Risk

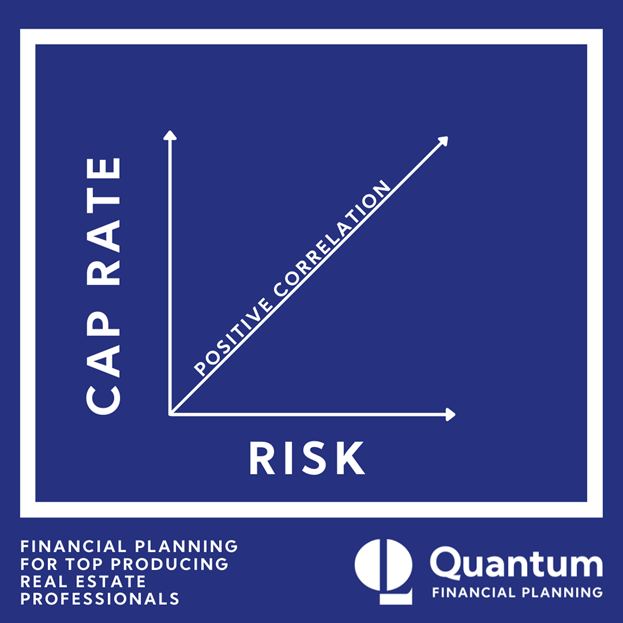

One big caveat to simply searching for the highest cap rate possible when finding an investment property is the relationship between cap rates and risk.

Typically, the amount of risk that comes with an investment property should move in tandem with the cap rate.

So, by the book: Higher cap rate = higher risk.

This is one area where your market expertise can come into play.

Real estate is not an efficient market—as compared with the stock market.

This is due to a variety of factors, but probably the biggest is that the availability of information is much, much more limited. This limitation especially applies to commercial real estate where there is no MLS to aggregate the data.

Because there is less information available, your advanced market knowledge could potentially allow you to identify a property that has a disproportionate relationship of cap rate to risk.

Cap Rates for Single-Family Residential Properties

The good news when it comes to single-family residential properties is this: You have the tools needed to make a confident and informed decision.

By running both a cap rate analysis and your CMA, you should get a good feel for where the property stands.

And one last thought: While this is likely an obvious statement, cap rates are meaningless for real estate investments where annual cash flow is not a consideration, such as a flip.

A flip is a short-term business model that aims to increase the sales price of a distressed property by bringing it back to life for the new owner.

The one exception would be if you were flipping a property to turn it into an income-producing rental at completion.

Bottom line: Cap rates are all about the income!

The Achilles’ Heel of Cap Rates

While cap rates are the most widely used metric for evaluating income-generating investment property, they come with shortfalls.

Arguably, the biggest downside to cap rates is that they incorporate only a snapshot in time—meaning they focus on current value and current income and disregard everything else.

There are four ways you receive value from income-producing real estate investments:

- Rental income

- Appreciation of market value of the property

- Tax benefits

- Amortization (leverage/use of debt)

So, to fully understand the potential benefits and flaws in an income-producing investment property, an analysis past a more basic cap rate is required.

Enter the APOD.

APOD Analysis: A Holistic Look at Investing in Income-Producing Real Estate

Where a simple cap rate calculation falls short, the Annual Property Operating Data (APOD) analysis steps up big time.

What is APOD in real estate? This calculation was created by the CCIM Institute and allows for a deeper dive into the income cash flows, appreciation, tax benefits, and amortization of an income-producing investment property.

An APOD analysis typically spans 10 years, allowing you to see how the above factors affect the property over time and filling in the big gap left by a stand-alone cap rate metric.

Given the holistic nature of an APOD analysis, the data required to generate the actionable output is expansive. Whereas a cap rate calculation requires a relatively small amount of data inputs, you will need a wider range of inputs to utilize an APOD, including:

- Total purchase price of the property, including acquisition costs and loan fees

- Potential rental income less an assumed vacancy rate

- Expenses (most can be pulled from the Schedule E on your tax return)

- Mortgage data, including outstanding balance, interest rate, amortization period, and loan term

- Cost recovery data (depreciation schedule)

- Your personal marginal income tax bracket and capital gains tax rate

- Cost of completing a sale of the property

While the work required to generate such an extensive analysis is great, equally so is the value of the output.

The APOD will calculate an internal rate of return (IRR), both before- and after-tax, for the property analyzed.

Again, there is value to having an IRR instead of simply a cap rate. The IRR includes the four value-generating aspects of income-producing real estate that we reviewed earlier:

- Rental income

- Appreciation of market value of the property

- Tax benefits

- Amortization (leverage/use of debt)

Integrate the Investment into Your Overall Financial Plan

Once you have evaluated a property on a stand-alone basis, the next step is to assess how this investment fits into your overall financial plan.

Here are questions to ask yourself to help determine if the property fits in your plan:

- Always start with your emergency fund: Is your cash emergency fund fully funded, and will this transaction affect the balance?

- Diversification: How is your overall net worth allocated? Are you creating a balanced asset allocation, or are all your eggs in one basket?

- Cash flow: How will this investment affect your monthly cash flow? Does this asset fit within your cash management plan?

- Taxes: What is the most efficient way to fund the purchase? Are you ready for the tax implications if you liquidate an asset?

- Amortization: Will you use debt and the leverage that comes with it to fund this investment?

- Time horizon: What is the long-term goal of the purchase? Cash flow in retirement? Appreciation of the asset?

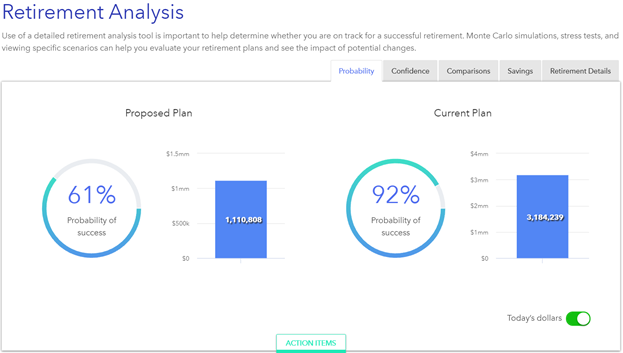

As you tackle these questions, financial planning software could help immensely in figuring out how adding another income-producing investment property fits within your net worth.

Source: Sample snapshot taken from RightCapital financial planning software.

Knowledge Is Power

When investing in anything, those who obtain as much information as possible for informed decision-making have the advantage.

This is especially true when the information is not readily available without putting in extra work.

Your toolbox for obtaining and creating actionable investment data for income-producing real estate starts with your niche market expertise, and your ultimate decision must flow through to the financial data of your personal situation.

6 Big Takeaways

- One of Top Producers’ most significant financial advantages is the ability to leverage their market expertise:

- The ability to identify an opportunity or inefficiency in the real estate market with your niche knowledge base

- The ability to execute the transaction for a reduced cost (compared with a standard investor)

- Financial calculations can extend your ability to make a smart investment decision.

- Cap rates are a great place to start but have limitations.

- There are four ways that income-generating real estate creates value:

- Rental income

- Appreciation of market value of the property

- Tax benefits

- Amortization (leverage/use of debt)

- An APOD analysis can provide a more comprehensive view of a property by accounting for all four value-generating attributes.

- The final step in making your investment decision is evaluating the alternatives.